Editor’s note: Gordon Ritter is a founder and general partner at Emergence Capital, a leading venture capital firm focused on cloud companies. He was an early investor in Salesforce.com and Veeva Systems, and he is currently chairman of Veeva. Follow him on Twitter @gordonritter.

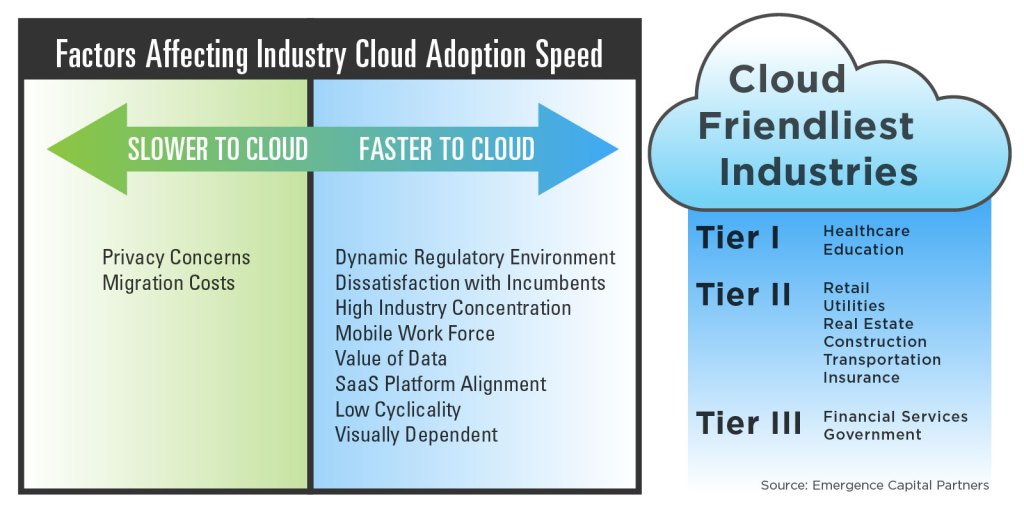

The benefits of an industry cloud strategy are clear. But are there certain industries that are more cloud friendly? To answer this question, we analyzed industries using a framework that ranks each one based on eight factors that speed up cloud adoption and two factors that slow things down.

The Top Cloud-Friendly Industries

Two industries stand out as the most cloud-friendly: healthcare and education. Healthcare has the most traction, with focused and fast-growing cloud companies in many facets of this massive and concentrated industry. In addition to Veeva, companies such as Doximity, CareCloud and PracticeFusion are getting traction, and Athena Health has been successful for years. The cloud helps these companies stay current in a strongly regulatory industry.

Within education, universities and school districts have shown a willingness to try cloud solutions, particularly those that are designed for non-desk workers and leverage big data. We have seen a range of companies make inroads, including Coursera, Edmodo and Schoology, as well as two from Emergence’s portfolio — Top Hat and Civitas Learning.

The next tier down includes industries such as retail, utilities, transportation, real estate, construction and insurance, each of which score high on several dimensions. The retail sector looks promising due to its mobile workforce, visual elements, and big data value, and we anticipate major shifts in the software used to drive that industry over the coming years. While these sectors face more hurdles relating to fragmentation and cyclicality, companies such as Real Page (real estate), Textura and PlanGrid (construction), Drivewyze (transportation, Emergence portfolio company) and Guidewire (insurance) show the potential for cloud solutions in these industries.

Finally, a few industries such as banking and government will likely be among the slowest to move to cloud technology. While these industries have great potential given their massive IT spending, it may take a number of years to overcome the privacy concerns and high migration costs. We are starting to see some early progress with companies such as Addepar and nCino; however, many sub-sectors in the financial services industry may not benefit from the revenue expansion and cost savings offered by the cloud for some time.

What Makes An Industry Cloud-Friendly?

Below are eight factors that increase the potential for industry cloud success, as well as two factors that will slow things down. To arrive at these factors, we reviewed material for public industry cloud companies, such as Veeva, Textura, Dealer Track, Real Page, Athena Health, and Fleetmatics. In addition, we based our analysis on the growth metrics we have seen through meetings with hundreds of private-industry cloud companies.

Eight Factors That Impact Industry Cloud Adoption Speed

- Dynamic regulatory environment. Software deployment through the cloud dramatically reduces the complexity of delivering updates and revisions. In the world of on-premise software, new regulations often mean company-wide software upgrades on every desktop and laptop – a burdensome process for IT professionals. Industry cloud platforms enable rapid and “auditable” deployment of new features or functionality that are required to comply with regulatory changes.

- Dissatisfaction with incumbents. Unhappy executives grumbling about their existing software and systems can be good news. Users of incumbent software may have grown accustomed to changing their workflow process to accommodate a one-size-fits-all system, but once customers get a taste of a vertical solution designed specifically for them, they realize the lack of value in a horizontal offering.

- High industry concentration. Industry cloud solutions enable more efficient sales and marketing processes, particularly in highly concentrated industries in which fewer than 50 companies represent over 80 percent of revenue. By concentrating sales energy on a limited set of companies, customer acquisition costs (CAC) can be especially attractive. In addition, industry concentration helps with word of mouth recommendations, further improving sales and marketing efficiency.

- Mobile workforce. Emergence Capital has seen an increasing number of promising industry-specific, mobile-first cloud solutions, and many of these are focused in verticals with high percentages of non-desk workers. For the first time, workers in real estate, construction, retail, education, healthcare, and transportation have cloud applications that can be used on their smartphones and tablets, or even Google Glass.

- Value in data. In many industries, the ability to access and analyze tremendous amounts of data (“big data”) is highly valuable. Retailers rely on big data to make sourcing, staffing and pricing decisions and financial services firms integrate sophisticated data models into nearly everything they do. Cloud architectures are uniquely good at sifting through large datasets. Additionally, cloud companies can capture new proprietary data streams by adding software features that capture new end-user data and behavior. In the insurance industry, Progressive’s Snapshot service is an example of not just mining existing data but creating new data points.

- SaaS platform alignment. Many of the early industry cloud leaders have built their solutions on existing horizontal cloud platforms, such as Salesforce.com and Amazon’s AWS. The ability to leverage platforms can speed time to market and enable a young company to focus on what is specific to the industry rather than building the underlying infrastructure.

- Industries with little to no cyclicality. Industries that tend to be immune from financial cycles are better candidates for cloud solutions for two primary reasons: First, seasonal or annual forms of cyclicality make it difficult to build recurring revenue businesses, the hallmark of most SaaS businesses. Second, moving to a cloud solution often requires some initial IT investment, and this can be hard to make if an industry is in a “down cycle.”

- Visually dependent. Industries such as real estate, manufacturing, construction and retail rely heavily on visual representations, making industry cloud platforms the best solutions to integrate visual images. In addition, visually dependent industries can leverage the powerful cameras on mobile devices. Images can be updated from one location and pushed out to all parties, often via tablets that are well suited to showcase visual images. For example, in the construction industry, PlanGrid is transforming collaboration around blueprints.

Two Factors That Slow Industry Cloud Adoption Speed

- Privacy concerns. One of the core tenets of SaaS infrastructure is that data is hosted “off-site” in the cloud. In industries such as banking, consumers and regulators are concerned about the potential for security breaches with this data structure. In fact, financial services companies have some of the largest IT budgets of any industry because they tend to build and run most of their systems in-house. While leading SaaS companies take extensive precautions to institute the highest level of data privacy, it may take many years to build enough comfort with these platforms.

- Migration costs. Shifting to a cloud model requires a software transition that can be complicated and expensive. In industries such as transportation or manufacturing, software changes can lead to errors, lost revenue and customer dissatisfaction. High switching costs will reduce the appetite to make the change to an industry cloud solution, even if the next-generation software might ultimately be better. This is particularly the case if cloud solutions start with back-office solutions that tend to focus more on cost reduction rather than revenue enhancement.

Based on our analysis, we see potential for substantial new industry cloud leaders to continue to emerge over the next few years, particularly in the more cloud-friendly industries such as healthcare, education, retail and transportation. Industry cloud companies have been performing well in the public markets, and investors appreciate the capital efficiency that comes from being able to focus on customers in one industry. Gone are the days when industry verticals could be dismissed as niche plays. Today, they are the future of the cloud.

Category: Dario Franchitti fiona apple zac efron Disney Infinity Hannah Davis

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.